What is the Capital Framework?

The Capital Framework is a fit-for-purpose tool designed to ensure that Government investment in infrastructure projects results in maximum public value to the ACT community. It provides practical assistance to Agencies proposing investment projects and developing Business Cases, and to advisors assisting Agencies in this process. It helps shape proposals, inform investment decisions and track outcomes and benefits.

The Capital Framework also complements other Government policies, strategies and requirements for infrastructure Business Case submissions at both ACT and Commonwealth Government levels.

Objectives of the Capital Framework

The Capital Framework is critical to Government to ensure that investments are prioritised, planned and developed appropriately. The purpose of the Capital Framework is:

To provide consistent, structured and fit-for-purpose guidance to support Agencies in methodically undertaking robust analysis of infrastructure projects to inform Government investment decision making.

The Capital Framework has four strategic objectives:

- Determine whether investment is justified – by providing both qualitative and economically measurable information to assess and prioritise capital investment. This process enables Government to allocate limited funds appropriately to suitable projects. This objective is achieved primarily through the Strategic and Policy Alignment, Needs Analysis, Options Analysis and Economic Appraisal (with a focus on both quantitative and qualitative benefits)

- Optimise spending – toensure that Government spends its limited funds in a manner that optimises value for money outcomes, by allocating risk to the contractual party that can best manage it. To achieve this objective, the Project Team must apply a methodical and consistent approach to:

- Risk identification and assessment

- Financial analysis

- Delivery model selection

- Periodic review of the contingency allowance

- Develop the project such that it is ready for procurement and delivery – by ensuring sufficient development of the project scope, timeline and budget, and making an optimum allocation of project risks, to enable efficient project procurement and delivery; and demonstrating the ethical, social and environmental benefits that will be pursued as prescribed in the Government Procurement (Charter of Procurement Values) Direction 2020 (ACT).

- Monitor and report on the realisation of the expected benefits resulting from the project– to confirm that any business changes needed to enable benefits realisation are taking place, and to report on whether the project is achieving the benefits forecast in the project Business Case.

Collaboration is a critical principle of the Capital Framework

To ensure successful project development, the Project Team must ensure that continuous collaboration with key stakeholders occurs throughout the entire Capital Framework process. Key stakeholders should include iCBR, FABG, ICA, EFG, and DDTS as well as other Agencies that may have an interest in the project (such as those responsible for or affected by its delivery or operations) or are responsible for interrelated projects. Collaboration will support:

- More comprehensive and robust project development

- A greater understanding of the project’s risks, uncertainties and challenges and any mitigation measures required

- A greater understanding of the project’s opportunities to optimise its expected benefits

- Early identification of project interdependencies to reduce inefficiencies and manage interfaces appropriately

- More seamless review and approval processes as key stakeholders have been involved throughout the process

- A higher likelihood of project success.

How does the Infrastructure Investment Lifecycle relate to the Capital Framework?

The Capital Framework supports the Infrastructure Investment Lifecycle and provides practical guidance and tools to assist in progressing a proposed infrastructure investment through its lifecycle and promoting the best investment outcomes for the ACT.

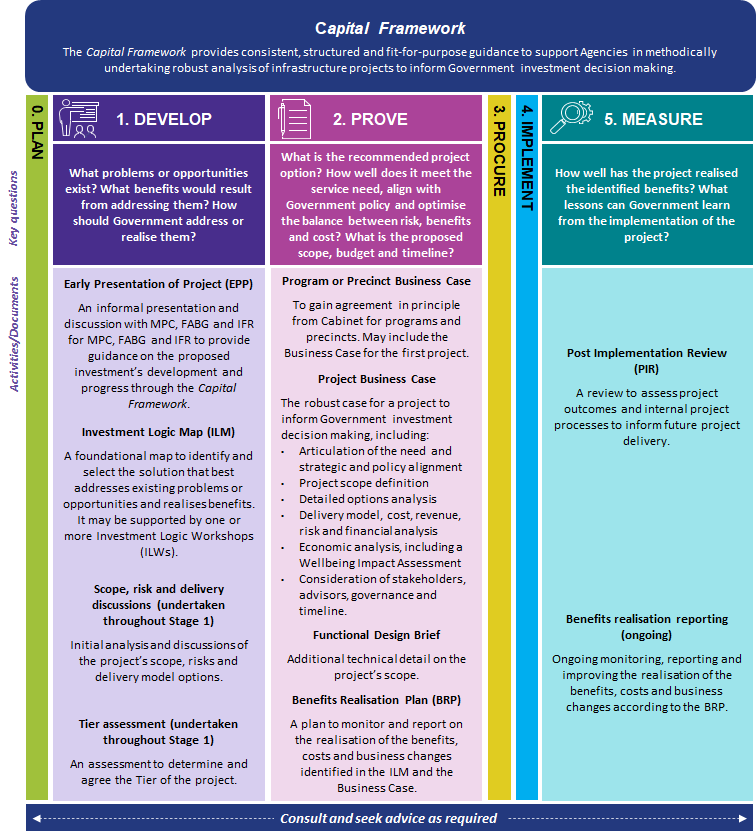

The Capital Framework provides guidance on three stages of the Infrastructure Investment Lifecycle, as shown in Figure 1 above. These are:

- Stage 1 – Develop

- Stage 2 – Prove

- Stage 5 – Measure.

Stage 0 – Plan relates to Government service planning processes that are outside the scope of the Capital Framework.

Although the Capital Framework does not cover Stage 3 – Procure and Stage 4 – Implement, the Capital Framework has intrinsic implications for these stages of the Infrastructure Investment Lifecycle. The Procurement ACT website provides guidance and factsheets to support Stage 3 - Procure.

iCBR’s Project Delivery Framework defines how iCBR provides support to Agencies through Stage 3 – Procure and Stage 4 – Implement. For more information on the iCBR Project Delivery Framework contact the iCBR Project Management Office.

More information on each of these stages can be found in the references provided in Further guidance material.

The Capital Framework process

The diagram below summarises the three stages of the Capital Framework process.

The Capital Framework process

Note Stage 2 – Prove may also need to include a Project Concept Brief (PCB), should the Government decide to run a two-stage Budget approval process. FABG will issue guidance in the Budget Process Rules on what material Project Teams need to include in the PCB.

The Project Team is encouraged to commence Stage 1 – Develop early in the development of the project, particularly to facilitate early feedback from iCBR, FABG, ICA and EFG; and to allocate and utilise resources efficiently. However, the timeframes over which the Project Team should progress a project through the Capital Framework will vary on a project-by-project basis, depending on a project’s complexity and scale. The timings of Stage 1 – Develop and the early activities of Stage 2 – Prove are not directly linked to the Budget process, so as to enable flexibility. Therefore Project Teams are encouraged to undertake these processes as early as practicable, which may be prior to the Budget cycle. As the Business Case is a key document in seeking Budget funding, the Project Team needs to ensure its completion within the Budget timeline (see How does the Capital Framework fits into the Budget cycle?). Further guidance on how to undertake each of these activities is listed in Further guidance material.

Business Case for Project Development Funding

Normally, Agencies should use their own resources and recurrent funding to develop project Business Cases. However, some complex projects (likely to be Tier 1 projects) require increased resources to undertake the work to build a comprehensive Business Case, including potentially undertaking a detailed feasibility study, developing a concept design and cost estimates, and using experienced consultants to help write the Business Case itself. Agencies may request funding to progress a project through part of Stage 1 and/or part or all of Stage 2 of the Capital Framework through a Business Case for Project Development Funding. The Business Case for Project Development Funding needs to provide an overview of the key project characteristics, the reason for the Project Development Funding request and information on how the Project Team will develop the project.

The Project Team should use the separate template provided to develop a Business Case for Project Development Funding, which includes guidance on the information that is required.

Generally, the Sponsoring Agency should use its own resources and recurrent funding to develop the Business Case for Project Development Funding.

Who should use the Capital Framework?

All Agencies should use the Capital Framework when progressing a proposed infrastructure capital investment through the Infrastructure Investment Lifecycle (see What projects fall under the Capital Framework?). Advisors should also use the Capital Framework Guidelines when supporting Agencies through the Infrastructure Investment Lifecycle.

Where projects are not covered by the Capital Framework (see What projects fall under the Capital Framework?), Agencies (and their advisors) can still refer to the Guidelines where they may be helpful to inform other processes. For example, an Agency may use the Investment Logic Map and Workshop Guidelines if they identify problems in service delivery or improvement opportunities that do not necessarily require new infrastructure but can be addressed through organisational changes or service delivery improvements.

What projects fall under the Capital Framework?

The Capital Framework applies to all physical infrastructure projects, including building works, roads and other urban and civil construction. It also generally applies to projects for the acquisition of Property, Plant and Equipment (PPE), unless agreed otherwise with FABG and ICA. The Project Team generally will need to develop a Business Case for all such projects under the Capital Framework.

The Capital Framework also applies to User Charge Public Private Partnership (PPP) projects procured by the Government, even if there is no Government contribution to either their financing or their ultimate funding. Such projects include ones where, ostensibly, the Government is buying a service but the provision of that service requires capital expenditure financed by the private sector (but funded from payments by the Government or from user charges).

Although the Guidance material within the Capital Framework may be used to inform other investment appraisal processes, the Capital Framework does not explicitly cover:

- Business systems and ICT infrastructure projects, although it does apply to physical infrastructure projects that include ICT components, provided these components are not the core of the project. DDTS is currently in the process of developing Best Practice Design and Delivery guidelines. The Project Team should refer to DDTS for further information and guidance. These types of projects may also use relevant parts of the Capital Framework Guidelines as required. For infrastructure projects with significant digital data or technology components, the Project Team must refer to the Best Practice Design and Delivery guidelines alongside the Capital Framework to ensure both requirements are covered. All Business Cases with a significant digital, data or technology component are to be reviewed by the Budget Assessment Sub-Committee (BASC), which reports to the Technology Governance Group (TGG). BASC provides strategic investment advice at both Concept Brief and Budget Bid stages, which supplements Treasury advice and provides an opportunity to discover cross-directorate investment opportunities

- Projects developed by Public Trading Enterprises (PTEs) that they fund from their own resources (for example, some housing projects undertaken by Housing ACT) do not require specific Budget funding

- Projects seeking Budget funding solely for recurrent operations (unless directed otherwise by FABG and ICA). However, where Agencies request Budget funding to develop a Business Case for a capital project, the funding submission does fall within the scope of the Capital Framework (see the template for a Business Case for Project Development Funding

- Projects delivered under the Better Infrastructure Fund, which are typically small in nature and managed by Agencies internally.

For projects that are seeking joint funding by the ACT and Commonwealth Governments, the Capital Framework provides guidance on how to develop a Business Case to meet both governments’ requirements.

Projects, Programs and Precincts

The Capital Framework Guidelines primarily refer to projects.

When developing a Program or Precinct, the Sponsoring Agency should first develop a Business Case for the whole Program or Precinct before developing individual Business Cases for projects within the Program or Precinct.

The definitions of a project, a Program and a Precinct are below:

- Project: A discrete one-off set of activities proposed to be undertaken to achieve a specific objective and outcome, together with associated expenditure and revenues

- For example, a project may involve the expansion of a school. The capital expenditure may affect recurrent expenditure through operations and maintenance of the additional facilities

- Program: A discrete set of interrelated projects and associated expenditure and revenues. A Program includes several individual projects that have a strong relationship to each other and are staged in a coordinated manner over time. These projects are often procured separately and sequentially, and combine to realise an ultimate outcome that cannot be achieved by an individual project alone

- For example, a major reconfiguration of a road may be structured as a Program, with individual projects making up the stages of the road’s reconfiguration. The capital expenditure may affect recurrent expenditure through the operations and maintenance of each project within the Program

- Smaller investments (including those co-funded by the Commonwealth Government) may be treated as a Program of works. This is often referred to as an ‘omnibus project’

- Precinct: A discrete set of geographically interrelated projects and associated expenditure and revenues. A Precinct includes several individual projects that are located in close geographic proximity. These projects combine to realise an ultimate outcome that cannot be achieved by an individual project alone

- For example, a series of developments within the land release program may be considered as a Precinct. The capital expenditure may affect recurrent expenditure through the operations or maintenance of the Precinct.

The Project Team may include the first project of the Program or Precinct within the Program or Precinct Business Case.

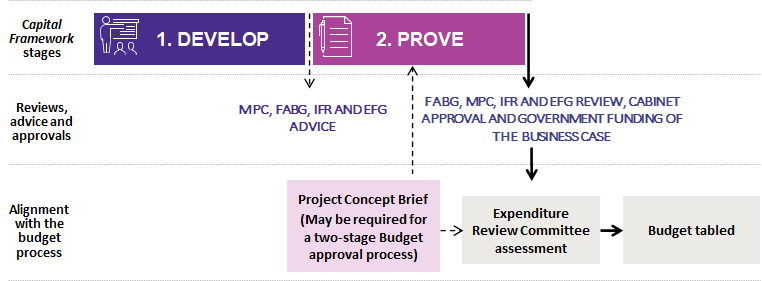

How does the Capital Framework fit into the Budget cycle?

The Capital Framework complements the Budget process. Its stages are designed to support the development of Business Cases for consideration by the Expenditure Review Committee (ERC) of Cabinet for Budget funding.

All Business Cases must follow the Budget Process Rules issued by FABG annually. This may include the need for a PCB(s) if the Budget is a two-stage one. Business Cases must also have authority from the Chief Minister to come forward in the Budget year.

The timings of Stage 1 – Develop and the early activities of Stage 2 – Prove are not directly linked to the Budget process, so as to enable flexibility in the timing of these activities for sufficient project development. However, the Project Team must complete the PCB (if required) and the Business Case in time for consideration by ERC and Cabinet for inclusion in the Budget, in alignment with normal Budget cycle timing. The alignment of the indicative timing of the Capital Framework with the timing of the Budget is shown in the Alignment with Budget process diagram below.

Alignment with Budget process

The Sponsoring Agency should engage relevant Ministers early in the Budget process on the projects they plan to submit for funding, ideally before starting the processes outlined in the Capital Framework.

The Capital Works Program, as published in the Budget, represents Government’s forecast program of works over the next five years. The Capital Works Program is guided by the ACT Infrastructure Plan (the Infrastructure Plan), which provides an integrated framework for multi‑decade infrastructure planning and development.

Footnotes: